The cost of divorce financial planning: A step-by-step guide to what you’ll spend (and save)

Divorce is a rollercoaster where you're expected to make life-altering money decisions while also dealing with grief, anxiety, and maybe your ex’s refusal to return the air fryer.

Financial choices you make during the divorce process affect you for the rest of your life. You know you need to prioritize them, but you’ve got enough on your plate right now.

Enter the Certified Divorce Financial Analyst (CDFA). Think of them as your money-savvy bestie during the split. They’re going to help you untangle the dollars and cents before you accidentally agree to a terrible financial deal.

But what does working with a CDFA actually cost? And, more importantly, how much can they help you save? Let’s break it down.

This guide will walk you through:

Understanding what a CDFA does

What services you need

How much they range in cost

What you'll likely save and protect

Why is the cost worth it

In this article

- CDFAs make sure the numbers behind your settlement will work in real life.

- They catch hidden issues with taxes, liquidity, and debt that are often missed.

- The right guidance now can prevent years of financial stress later.

Read on to understand what else CDFAs provide and how much they cost.

What is a Certified Divorce Financial Analyst (CDFA)?

CDFAs are like the CFO of your divorce. They bring that same strategic, number-crunching, future-focused energy that a CFO brings to a company, except it’s all about protecting your money and your future. They’ll help you understand how every dollar split, asset divided, and decision made today could impact your financial life years from now.

Here’s what a CDFA does for you:

They break down the short- and long-term impact of your divorce settlement. That includes analyzing retirement accounts to make sure you're not getting the short end of the stick, protecting you from being stuck with joint credit card debt, and flagging any tax hits you might face from selling investments.

They run the numbers on different options so you can make informed choices. Whether it’s keeping the house or trading it for more retirement savings, they help you understand what each scenario means for your future lifestyle.

They dig deep into assets and spot red flags. If your ex owns a business, a CDFA knows how to look for hidden income, sketchy write-offs, or assets “magically” titled under someone else’s name.

They help you with a strategy for alimony, child support, and post-divorce budgeting. The focus isn’t just survival; it’s having enough to raise your kids, cover your needs, and help you rebuild wealth. The goal is for the money to last you through raising kids and well beyond.

What services does a CDFA usually provide?

A CDFA is your financial advocate when you're too overwhelmed to do it all alone. Here’s what their support typically includes:

Running the numbers: They analyze how your money holds up over time. They factor income, expenses, retirement savings, and taxes to make sure the math actually works for you.

Valuing your assets: From pensions and stock options to business ownership, they put a clear number on what everything’s worth. No more guessing, no more getting lowballed.

Scenario planning: They map out different “what if” options so you can see the impact of every decision before you sign anything. For example, what if I sell or keep the house?

Post-divorce budgeting: They help you create a real-life plan for your money once the dust settles. It outlines what you can afford, what needs to shift, and how to rebuild.

Tax impact analysis: They break down how splitting up accounts, property, or investments will affect your taxes. That way, don’t get surprised next April.

Planning for kids and long-term costs: From child support to future college expenses, they help you prepare for the financial responsibilities that don’t go away post-divorce.

Clarifying asset access: Not all assets are created equal. They help you understand what’s liquid (like cash) versus what’s locked up (like retirement accounts or real estate).

Expert support in court: If things go legal, they can show up as an expert witness to back up your financial position with facts, not emotion.

A CDFA doesn’t just look at what’s happening now; they make sure you’re set up for what comes next.

How much do CDFA services usually cost?

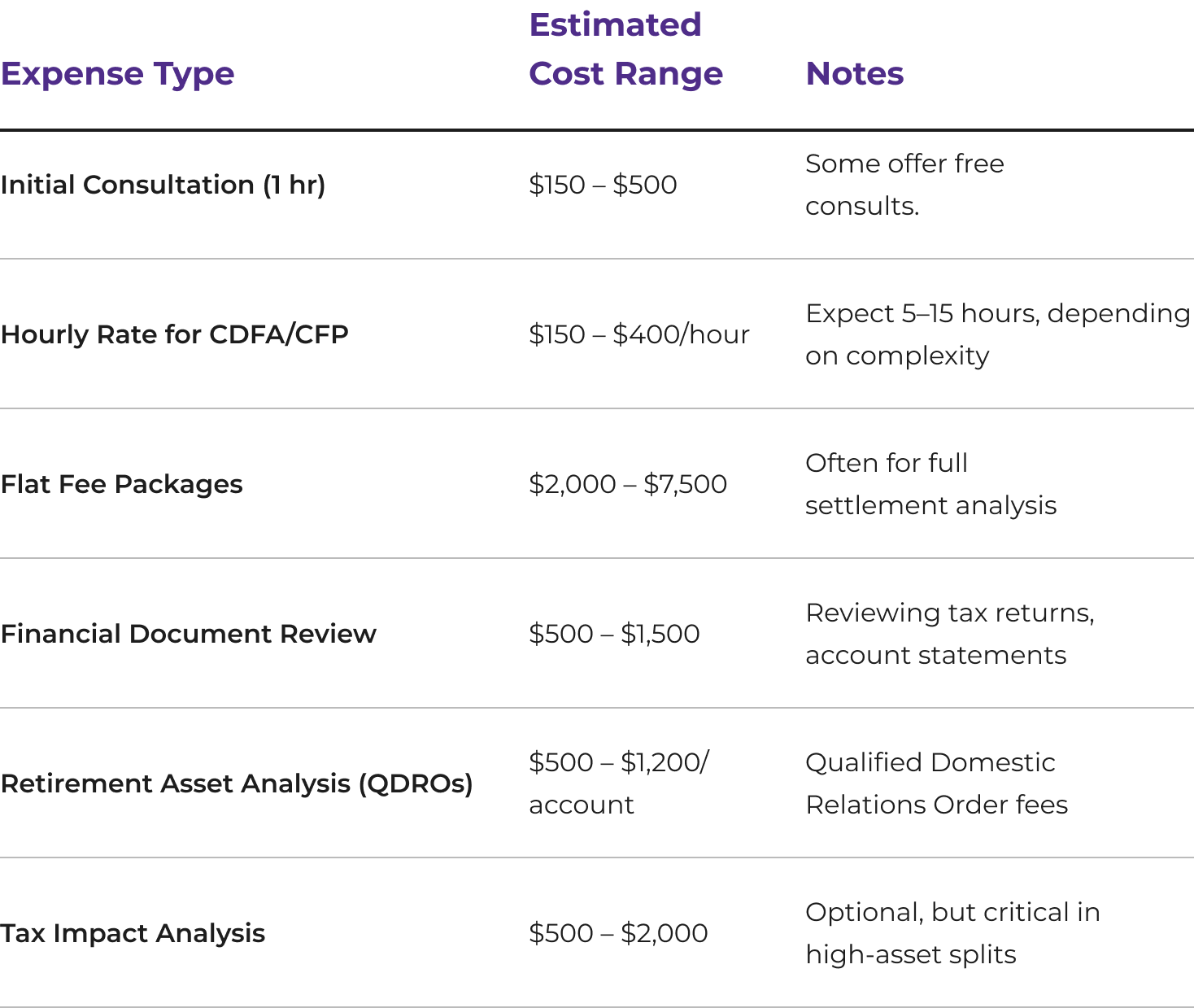

While prices can vary from firm to firm and depend on geography, a general range for divorce financial planning services can look like:

A moderate-to-complex divorce typically costs between $3,000 and $10,000. Most people land on the lower end of that range when things are relatively straightforward. That means things like fewer assets, no kids, a cooperative process like mediation or collaboration, and paperwork that’s organized from the start. The more complicated the situation, the higher the cost.

How much can using a CDFA save you?

A CDFA’s job is to uncover hidden risks in your divorce settlement, protect you from future hardship, and quantify every decision in after-tax, real-world dollars.

Paying $1,000 to $5,000 for that level of financial insight might feel like a lot, but it could protect much more in assets or income.

This level of support matters even more when things like real estate, retirement accounts, executive benefits, business ownership, pension, and children and long-term support are involved.

Think of a CDFA not as an expense but an investment in your financial future.

Here are a few examples.

Example #1: Avoiding a bad settlement

Here’s a real-world scenario where a CDFA can protect you from walking away with less than you deserve.

Let’s say you and your spouse are splitting two major assets:

A $300,000 401(k)

A house with $300,000 in equity

You agree to take the house. They take the 401(k). On paper, it looks even.

It’s not.

The 401(k) is pre-tax. It will be growing tax-free for many years. Then money gets hit with income taxes when it’s withdrawn, so the actual value is lower. The house, on the other hand, comes with ongoing expenses. We’re talking property taxes, maintenance, and potentially capital gains tax if you sell. Plus, if you ever need cash, your equity is tied up. You’d have to sell or refinance to access it.

Over time, you could walk away with thousands less in real, spendable money than your ex.

In this example, a CDFA:

Calculates the after-tax value of each asset

Models cash flow (e.g., can you afford the house?)

Makes sure both sides get a fair share of what everything is actually worth, not just what it looks like on paper

It isn’t about being greedy; it’s about being smart. A CDFA helps make sure you don’t agree to a deal that looks equal but leaves you behind.

Example #2: Protecting retirement

Say your spouse has a pension or a government retirement plan. Maybe they’re military, a teacher, or a government employee. You’re offered a lump sum in exchange for leaving the pension alone, and you agree. It feels simple and quick.

But that pension could pay out $2,000 to $4,000 a month for life. That adds up to hundreds of thousands of dollars in long-term income. Walking away from it or undervaluing it could mean leaving $100K to $500K+ on the table.

In this example, a CDFA protects you by:

Calculating the present value of a pension or retirement plan using actuarial tools. This lets you see exactly what that future income is worth today.

Makes sure the split is done correctly, using a Qualified Domestic Relations Order (QDRO) to divide retirement funds without triggering taxes or penalties.

Keeps you from trading long-term financial security for a quick payout now.

This is about protecting your future and not just settling for the present.

Example #3: Keep the house, or let it go?

You’re attached to the family home. Your kids grew up there and it’s hard to give it up. So, you accept less in retirement funds and cash to keep it.

Now you’re holding a high-cost, illiquid asset with little to no retirement savings. Fast forward 10 years. The house hasn’t gained much value, interest rates are high, and pulling out equity is expensive. You’re house rich, cash poor. Meanwhile, your ex has a retirement account that’s been growing steadily the whole time.

In this example, a CDFA:

Breaks down the financial reality of keeping the home versus selling it.

Compares long-term value from real estate to the flexibility of having more cash or retirement savings.

Strips out the emotion by showing you the numbers, clearly and objectively

Keeping the house might feel right, but your financial future deserves more than just feelings. A CDFA helps you make the decision that builds real stability.

How do you know if a CDFA is worth it for your situation?

Divorce is one of the biggest financial moments of your life. Lawyers protect your legal rights. CDFAs protect your financial future. And this matters because you only get one shot at the settlement. Divorce agreements are often final and difficult to change later. A CDFA helps ensure the deal you sign makes financial sense today and 10, 20, or 30 years from now.

Here’s what else they bring to the table:

They catch what lawyers can miss. They can let you know whether keeping the house actually makes sense, if you’ll still be set for retirement, and whether the split is truly fair once taxes and long-term impact are factored in.

They prevent expensive mistakes. Swapping a $100K retirement account for a $100K brokerage account might sound fair, but once taxes hit, it’s not the same deal.

They help you stay clear-headed. Divorce is emotional. A CDFA helps you step back, look at the numbers, and make choices that will work long-term.

They bring peace of mind. No second-guessing later. You’ll know your settlement makes sense for your life now and in the future.

If your divorce involves real estate, retirement accounts, kids, long-term support, or just big financial decisions, you deserve to have a CDFA in your corner.

Transform your divorce settlement from “I hope it’s fair” to “I’m going to be OK.”

Divorce changes everything. Your home. Your finances. Your future.

CURO helps you make sense of it all and covers the “you don’t know what you don’t know” stuff. Protect what you’ve worked for, take care of your kids, and start rebuilding a sense of stability with us.

This material is intended for informational/educational purposes only and should not be construed as investment, tax, or legal advice. CURO Wealth Management does not provide legal or tax advice. You should consult a legal or tax professional regarding your individual situation.