Interest Rates on Federal Student Loans to Increase for 2022-2023

Every May, interest rates on federal student loans are recalculated for the upcoming school year. The rates are calculated by combining the yield on the 10-year U.S. Treasury note with an extra fixed amount set by Congress.

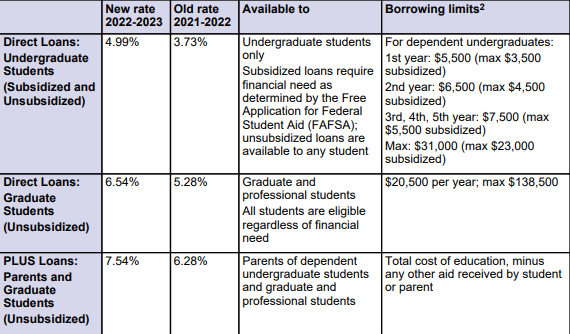

Based on this calculation, interest rates on federal student loans are set to increase for the 2022-2023 school year by more than 1%, the second straight year of increases. The rates apply to new federal student loans issued July 1, 2021, through June 30, 2022 (the interest rate is fixed for the life of the loan).

Unfortunately, soaring inflation has played a part in the higher rates. The Federal Reserve raised the federal funds rate by 25 basis points (0.25%) in March and by 50 basis points (0.50%) in May in an attempt to rein in rapid inflation. This had the effect of increasing the yield on the 10-year Treasury note, which in turn has led to higher student loan interest rates. The higher rates also come during a period of heightened public awareness about student debt, political pressure to cancel federal student debt, and six student loan payment pauses since the start of the pandemic; the current pause is scheduled to end on August 31, 2022.

*Prepared by Broadridge Advisor Solutions

Marianna Goldenberg, CDFA® is a financial consultant located at CURO Wealth Management, 1705 Newtown Langhorne Road, Suite One, Langhorne, PA 19047. She offers securities as a Registered Representative of Commonwealth Financial Network®, Member FINRA/SIPC. She can be reached at 215-486-8350) or at marianna@curowm.com.